This is Bob and my first post for the A&B website… Amber’s been doing a fabulous job with the website, and I really appreciate the time that she’s done to get a working blog together with beautiful pictures and stories! However, after noticing that *ahem* every post was written by her it seemed like it was time for me to step up and write one. I’ve been interested in writing a finance post, which this was a good one as while in Florida we went to a financial retreat with our good friends Stacey and Andy.

This post is going to be less pictures and more words to outline a bit how we have been able to afford the lifestyle that we now find ourselves enjoying. This has been a very long journey and we have been saving parts of our paychecks every month with the hope that someday we would be able to travel and not limited by our job’s yearly vacation allowance. We’ve been part of the Financial Independence Retire Early (FIRE) movement that has these core concepts:

- Spend less than what you make

- Invest savings in low-cost index funds

- Retire when your investments reach 25x your expenses

There are lots of details behind each bullet and a lot more information on the web about the FIRE movement so check out the other resources below to get more information or send me a note at contact@amberandbob.com if you’re interested. We’ve always been on the frugal side and have done a good job of not allowing our expenses to grow when we’ve made more money and saving the excess throughout the years. We’ve tracked our expenses in what some might call nauseating detail since about 2014 and this graph shows the delta between what we take in, mostly from our jobs, and our total expenses, including taxes and everything we’ve spent money on. Overall, our expenses have been fairly steady throughout this period as has our income.

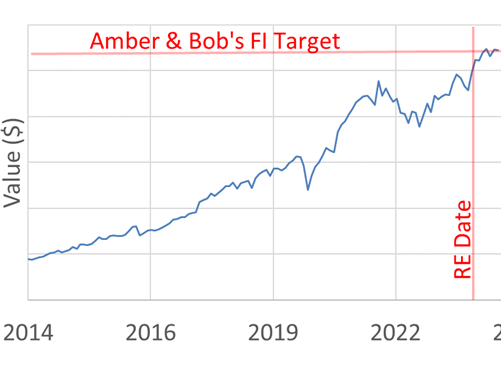

The gap between our income and expenses have gone into savings in a combination of retirement accounts (Traditional IRA, Roth IRAs, HSAs, 401k, 457, 403b and others), real estate (rental properties, primary residence, and commercial ventures), and taxed accounts (savings accounts, CDs, brokerage accounts and others). Over this same period, our net worth has grown, and we finally went over our financial independent (FI) number late in 2023 as shown in the graph below. Note that we retired early (RE) before we hit this number…but we were counting down for 2 years and figured we were close enough to make it work.

Being a part of the FIRE movement has been great and we’ve been trying to connect with other like-minded people for ideas and comradery. This lead us to join Baltimore’s Choose FI group and we went to most of the events and met some great people, including Stacey and Andy of Jacksonville, Florida when we were in the final months of our work (and there are Choose FI communities all over the world!)

Low and behold, we meet Stacey when we first arrived in Florida who mentioned there is a FIRE camp, CampFI, in a couple of weeks, happens to know a couple that are not going to be able to make it, and it is close to where we are staying! Amber and I pondered for a bit and then decided to go to the 2024 SE March camp! The link is below with the picture of all of us at the camp. Amber and I are toward the middle on the left.

The camp was awesome! It was great for making connections with smart like-minded people and being able to openly talk about finances with others was refreshing. It was hosted at a retreat center where we had our own room, all food was covered, we got t-shirts. There were some hosted talks about tracking software, travelling, insurance, and transitions into FIRE. And some breakout sessions about taxes, building companies, and drawdown strategies. So many great conversations and we traded information to several others throughout the weekend.

The last thing that I’ll mention about the Camp is that Amber, Bob, Stacey, and Andy were asked to be on a podcast by Maggie while we were at the camp one evening. Maggie wanted to interview both couples to have one that had just retired (Amber & I) and one was retired a couple of years (Stacey & Andy). It was a great conversation and Maggie did a great job wrangling us and putting together a good episode in front of a live audience, something that none of us had done previously! A link to the podcast is below.

We made some great connections at CampFI and will go again, we just need to figure out where and which one to put on the docket for next year.

Other resources:

https://www.facebook.com/groups/ChooseFIGreaterBaltimore